liberty home mortgage closing costs

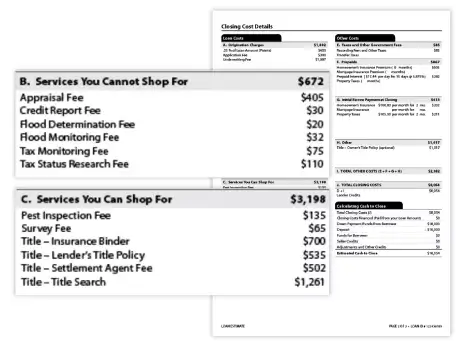

The three largest closing costs are the Federal Housing Administration FHA mortgage insurance the origination fee title and other closing settlement fees. Closing costs may apply.

Mortgage Rates Ct Liberty Bank

Some of this money may be used for down payment and the rest for closing costs.

. Your Closing may include some or all of these entities. Real estate agents your. This includes origination charges appraisal fees credit report costs title insurance fees and any other fees required by.

Offers 8000 in assistance to qualifying low- to middle-income buyers. One way to reduce the closing costs and get a no-cost. A Full Array of Mortgage Lending Products.

Put as little as 3 down and Liberty pays the PMI. Our Liberty County Florida closing cost calculator lets you estimate your closing costs based on your financial situation. Plus in certain communities get 2500 toward closing costs or to match your down payment.

Closing costs also known as settlement costs are the fees you pay when obtaining your loan. Enter the sales pricevalue of the house then tab. This form is to be used for estimation purposes only.

How To Use Liberty County Florida Closing Cost Calculator. Requires a five-year retention agreement. This is the amount of cash you have available to put down and to cover closing.

Some of those products include. For example a 300000 mortgage with 2 points has a cost of 6000 in addition to the closing costs described above. Closing costs are typically about 3-5 of your loan amount and are.

In an FHA mortgage the customer must put at least 35 of the sales price into the transaction. What are closing costs. Mortgage closing costs are all of the costs you will pay at closing.

Liberty Home Mortgages LLC is a mortgage broker located in North Atlanta and specializes in low closing cost home loans. We at Liberty Home Mortgage are able to get you the best rates on all types of loan programs well fit your needs. Must be a first-time homebuyer.

A sample principal and interest payment on a 30-year 150000 fixed rate loan amount with a 4250 interest rate 4317 APR is 73791. From the first call to closing our team is with you every step of the way. The initial MIP is either 05.

Mortgage Insurance Premium MIP The borrower will be charged both an initial MIP at closing as well as an annual MIP over the life of the loan. Ad Get Your Custom Mortgage Rate Quote Today. At Closing you and all the other parties in the mortgage loan transaction sign the necessary documents.

We offer a full line of mortgage products designed to help you purchase or refinance your home. Consult a Liberty Loan expert for actual values. FHA VA and USDA.

Faq Liberty Mortgage Corporation

Can Fha Closing Costs Be Rolled Into The Loan Fha Lenders

The Complete Guide To Physician Mortgage Loans

Ncrc S Hmda 2018 Methodology How To Calculate Loan Price Ncrc

Closing Costs In New York 2022 Finder Com

Best Reverse Mortgage Companies Of 2022 Money

What Is A Home Warranty Liberty Home Guard

8 Best Home Warranty Companies Of October 2022 Money

Mortgage Rates Ct Liberty Bank

2022 Best Mortgage Companies To Work For National Mortgage News

Liberty Home Mortgage Review Freeandclear

Patrick Cranmer Liberty Financial Mortgage Loan Officer Facebook

Home American Liberty Mortgage Inc

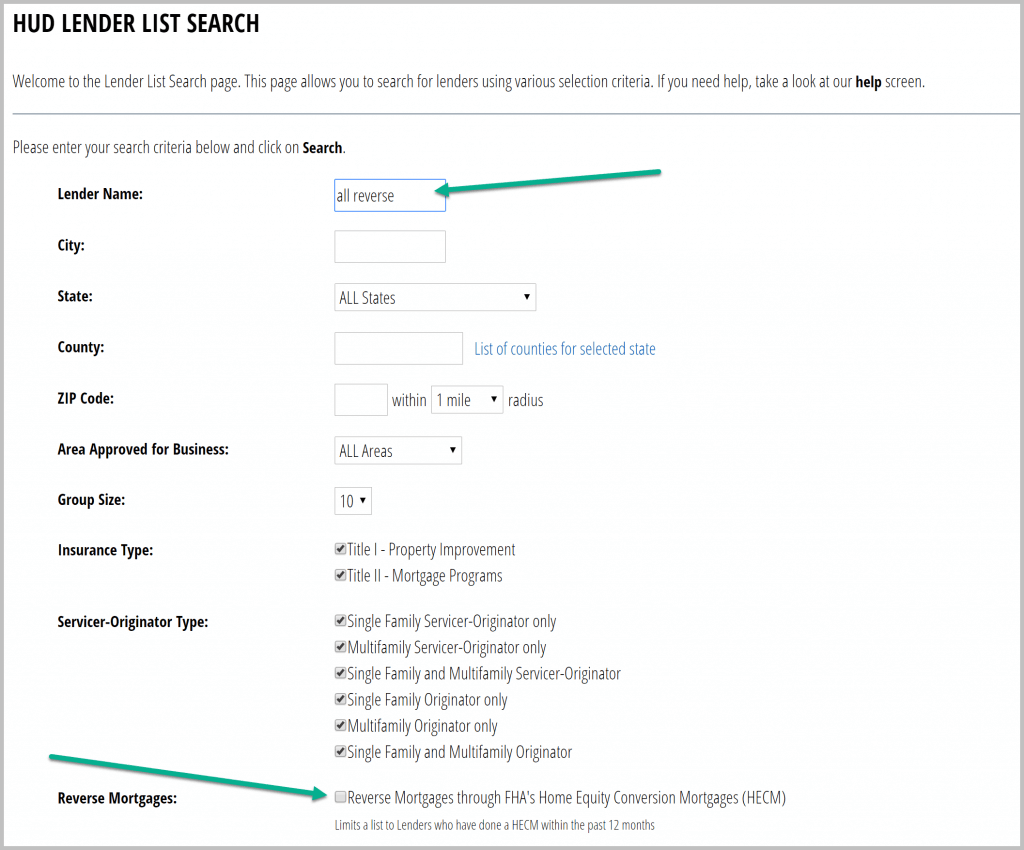

10 Best Reverse Mortgage Lenders Of 2022 Compare Rating Reviews

Va Home Loan Rates Guidelines Eligibility Requirement For Va Loans Lock In Low Mortgage Rates

.png)